7 Symptoms of Poor Cash Flow Within Your Business

1. Introduction

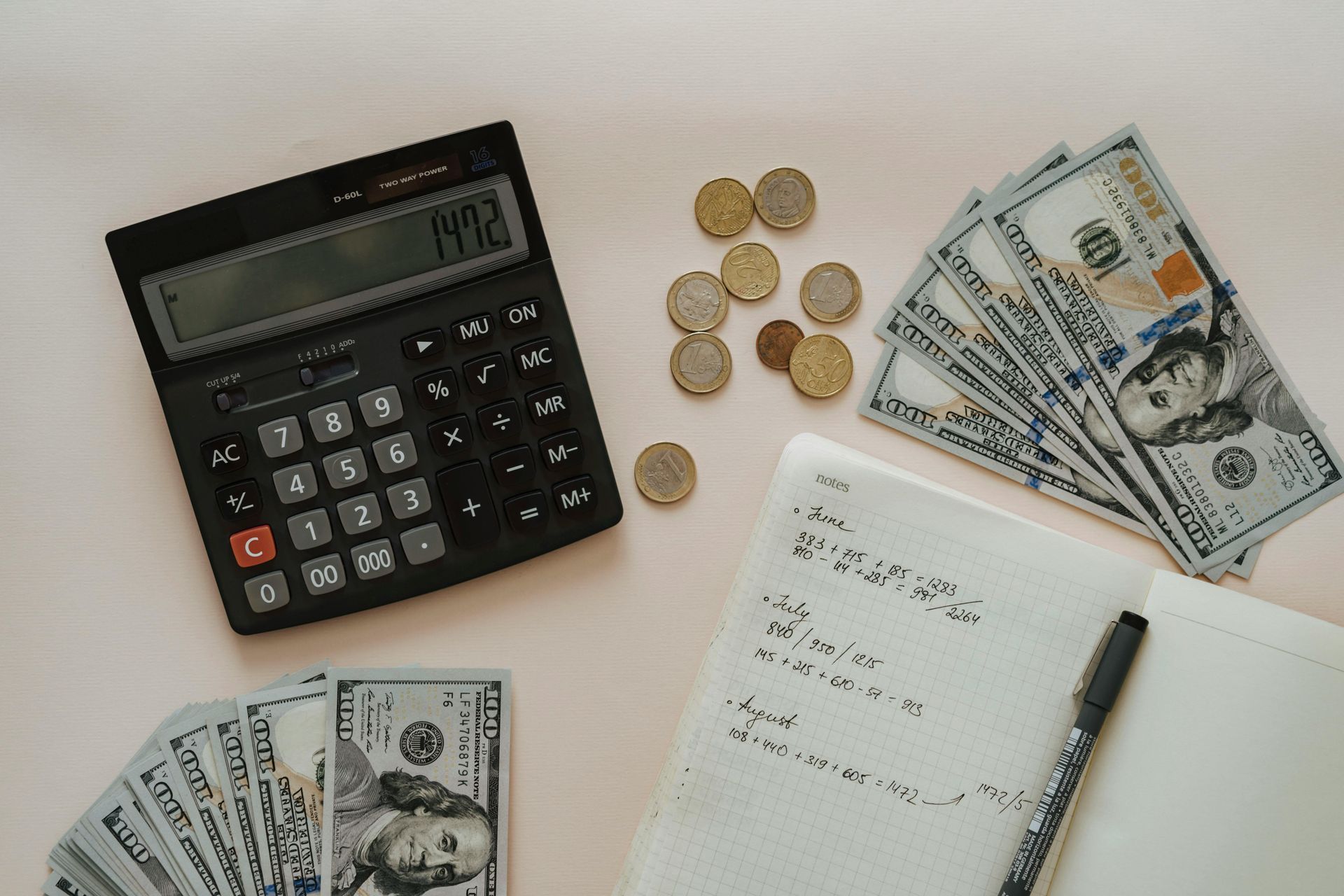

Cash flow is the lifeblood of any business. It represents the movement of money in and out of your business. A positive cash flow means your business is in a healthy financial state, while a negative cash flow could spell trouble. In this e-book, we’ll explore seven symptoms of poor cash flow.

2. Difficulty Paying Suppliers

Struggling to pay suppliers on time is a common symptom of poor cash flow. This could be due to delayed payments from customers, unexpected expenses, or poor financial management. If you find yourself constantly juggling payments to suppliers, it’s time to take a closer look at your cash flow.

3. Inability to Cover Regular Expenses

If you’re having trouble covering regular expenses like rent, utilities, or payroll, this is a clear sign of poor cash flow. This could be due to a variety of factors, including low sales, high overhead costs, or inefficient operations. Consider ways to reduce expenses and improve efficiency to boost your cash flow.

4. Declining Sales

Declining sales can lead to a decrease in cash flow. This could be due to market conditions, increased competition, or a lack of effective marketing. Consider implementing strategies to boost sales, such as improving your marketing efforts, offering new products or services, or exploring new markets.

5. High Debt Levels

High levels of debt can put a strain on your cash flow, as a significant portion of your income may be going towards debt repayment. If you’re struggling with high debt levels, consider strategies for debt management and reduction.

6. Lack of Cash Reserves

A lack of cash reserves can leave your business vulnerable to unexpected expenses or downturns in the market. Building up a cash reserve can provide a safety net and improve your cash flow.

7. Over-reliance on a Single Customer

Relying too heavily on a single customer can lead to cash flow problems if that customer delays payment or stops doing business with you. Diversifying your customer base can help protect your business from this risk.

Conclusion

Recognising the symptoms of poor cash flow is the first step towards improving your financial health. By taking proactive steps to address these issues, you can improve your cash flow and set your business up for success. Remember, the key to success is to take action. So, start today, and watch your cash flow grow!

Next Steps for you and your business

Here at Arthur Francis Accountancy, we have the knowledge and experience to rectify poor cash flow within your business. This can be from conducting a review of your business, creating a cash flow forecast or designing a budget. We even have experience in training team members on the basics of managing money to help eliminate the financial strain.

Please do not suffer in silence; contact us to see what help we can bring to you and your business.