Incomplete Records and What To Do

Incomplete Records and What To Do About It

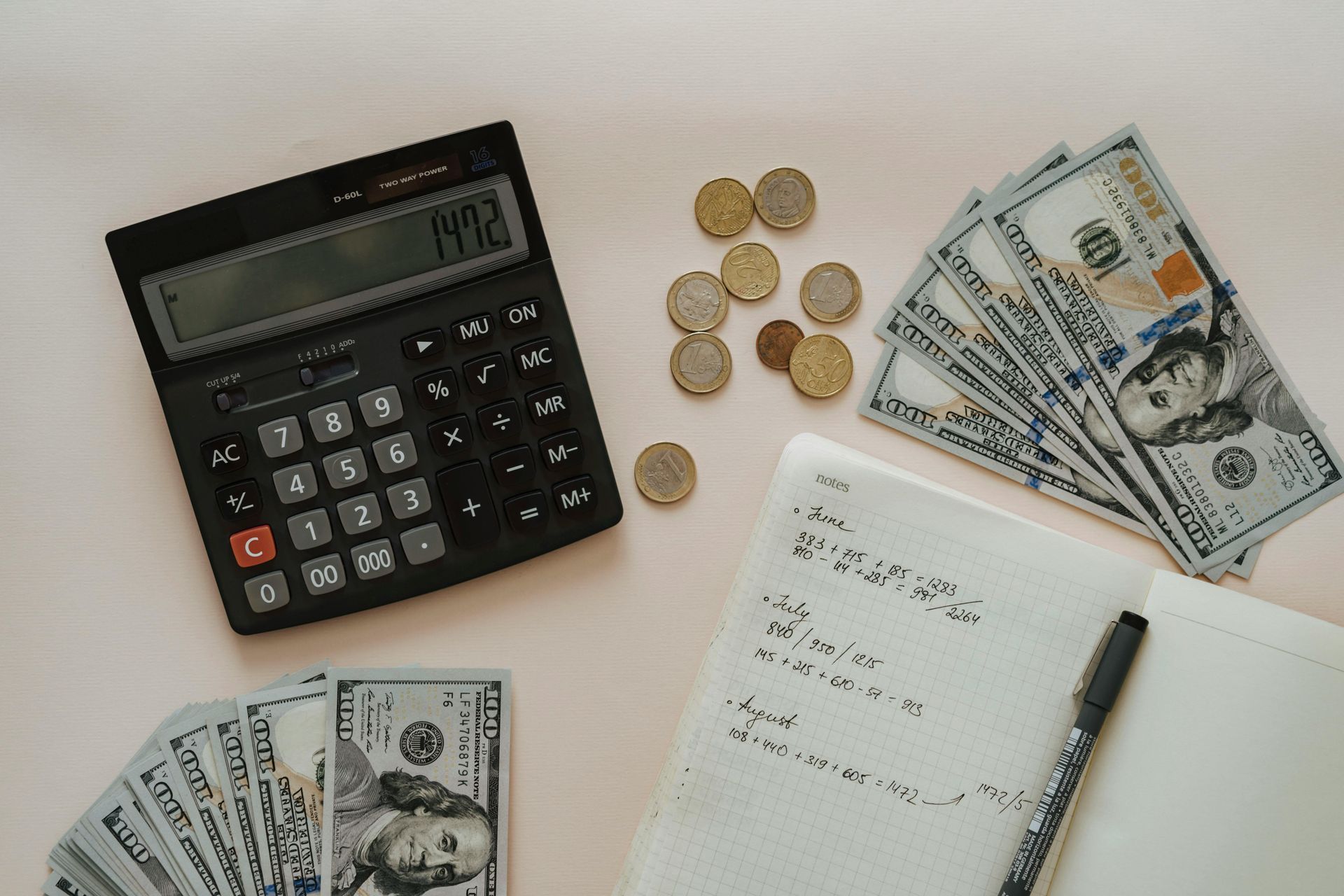

Introduction

In accountancy, incomplete records refer to a situation where a business's financial information is not fully or properly recorded, making it challenging to prepare accurate financial statements. This can occur for various reasons, such as poor record-keeping practices, loss or destruction of records, or intentional concealment of information.

Characteristics of Incomplete Records:

- Missing Transactions: Some business transactions are not recorded at all.

- Incomplete Documentation: Documents like invoices, receipts, and bank statements may be missing or incomplete.

- Unrecorded Adjustments: Adjustments for accruals, prepayments, depreciation, and inventory changes may not be recorded.

- Lack of Systematic Accounting: There may be no formal accounting system in place, leading to inconsistent recording of transactions.

- Single Entry System: In some cases, businesses may use a single-entry bookkeeping system rather than a double-entry system, leading to incomplete records.

Challenges Posed by Incomplete Records:

- Inaccurate Financial Statements: It is difficult to prepare accurate income statements, balance sheets, and cash flow statements.

- Tax Compliance Issues: Incomplete records can lead to errors in tax filings, resulting in penalties and interest charges.

- Poor Decision-Making: Management may make ill-informed decisions due to unreliable financial information.

- Auditing Difficulties: Auditors face challenges in verifying the completeness and accuracy of financial statements.

- Fraud Risk: Incomplete records can conceal fraudulent activities or financial irregularities.

Methods to Handle Incomplete Records:

- Estimation Techniques: Accountants may use estimates to fill in the gaps, such as using historical data or industry benchmarks.

- Reconstruction of Records: Where possible, reconstructing records from available documentation, bank statements, and third-party confirmations.

- Use of Control Accounts: Employing control accounts like bank reconciliations to identify and correct discrepancies.

- Single Entry to Double Entry Conversion: Converting single-entry records to a double-entry system for better accuracy.

- Regular Review and Reconciliation: Implementing regular reviews and reconciliations to ensure that records are as complete and accurate as possible.

Conclusion:

Dealing with incomplete records requires a systematic approach to reconstruct financial information as accurately as possible. It often involves significant detective work, professional judgment, and sometimes, reliance on indirect evidence to present a true and fair view of the business’s financial position.

If you feel that you are having issues with your accountancy software or processing your data then get in contact with us.